The Income Tax Department, under the Ministry of Finance, is one of the most vital government agencies in India. It is responsible for collecting direct taxes, enforcing tax laws, and ensuring compliance with tax regulations. Each year, the department offers a range of job opportunities, attracting candidates eager to build a career in public service. The Income Tax Recruitment 2024 is expected to open new vacancies across various positions, making it an excellent opportunity for those seeking a stable and rewarding career in government. In this comprehensive guide, we’ll explore the eligibility criteria, application process, selection stages, and preparation tips to help you succeed in securing a position within the Income Tax Department.

Overview of Income Tax Department Roles

The Income Tax Department offers a variety of positions, primarily divided into officer-level roles and clerical or support staff roles. Here are some common positions that the department typically recruits for:

- Income Tax Inspector: Responsible for assessing and examining tax liabilities, conducting investigations, and ensuring tax compliance.

- Tax Assistant: Assists in data entry, documentation, and other clerical tasks related to tax assessment and collection.

- Multi-Tasking Staff (MTS): Performs general duties such as dispatching files, supporting clerical staff, and helping maintain office records.

- Tax Recovery Officer: Involved in the recovery of outstanding tax dues, managing assets seized under tax default cases, and coordinating with other agencies as needed.

- Stenographer: Handles transcription, shorthand, and clerical duties, including correspondence and data management.

These roles provide a combination of office-based and fieldwork opportunities, allowing candidates to choose a career path that best suits their skills and interests.

Eligibility Criteria for Income Tax Recruitment 2024

The eligibility criteria vary depending on the specific position. However, the general requirements are as follows:

Educational Qualification

- Income Tax Inspector: A Bachelor’s degree from a recognized university is required for this position.

- Tax Assistant: Candidates should have a Bachelor’s degree and must possess basic computer skills, as data entry and typing are essential for this role.

- Multi-Tasking Staff (MTS): A high school diploma (10th pass) is typically sufficient for this entry-level position.

- Stenographer: Requires a high school diploma (12th pass) and proficiency in stenography and typing. Specific shorthand speeds may be required based on the grade.

Age Limit

- Minimum Age: Generally, the minimum age for applying is 18 years.

- Maximum Age: The upper age limit varies by position but typically ranges from 27 to 30 years. Age relaxation is available for reserved categories as per government norms:

- SC/ST: 5 years

- OBC: 3 years

- Persons with Disabilities (PwD): 10 years

Physical Fitness

For positions involving fieldwork, such as Income Tax Inspector or Tax Recovery Officer, candidates must meet certain physical fitness requirements. Details of these requirements will be provided in the official notification.

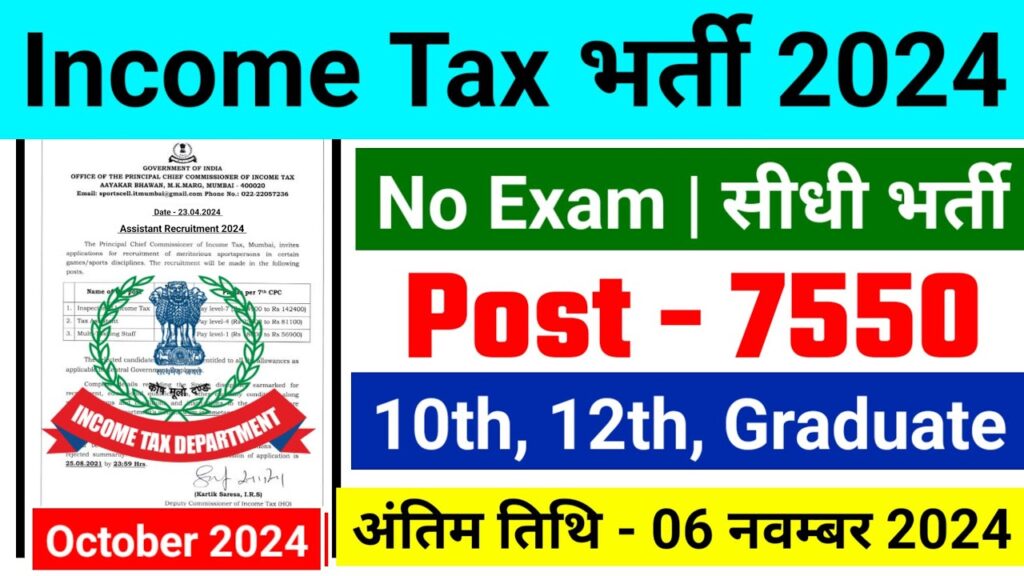

Important Dates for Income Tax Recruitment 2024

The specific dates for Income Tax Recruitment 2024 will be announced in the official notification. However, the general timeline is as follows:

- Release of Notification: Expected in the first quarter of 2024.

- Start of Online Application: Within one week of the notification release.

- End of Online Application: Typically 30 days from the start date.

- Admit Card Release: 10–15 days before the examination.

- Examination Date: Usually within 2-3 months after the application period.

- Result Announcement: 1-2 months after the examination.

For exact dates, candidates should regularly check the Income Tax Department’s official website or the recruitment portal.

Application Process for Income Tax Recruitment 2024

The application process for Income Tax Recruitment is generally conducted online. Here’s how to apply:

- Visit the Official Website: Go to the Income Tax Department’s official recruitment portal or the Staff Selection Commission (SSC) website, as SSC often conducts exams for these positions.

- Find the Recruitment Notification: Look for the notification under the ‘Recruitment’ or ‘Careers’ section. Carefully read the eligibility criteria, exam pattern, and other details.

- Register as a New User: Complete the registration process by providing your basic details such as name, email, phone number, etc. After registration, you will receive a unique registration ID and password.

- Fill in the Application Form: Log in with your registration credentials and complete the application form. Make sure to enter accurate information regarding personal details, educational qualifications, and work experience (if applicable).

- Upload Required Documents: Scan and upload necessary documents such as:

- Passport-sized photograph

- Signature

- Educational certificates

- Category certificate (if applicable)

- Pay the Application Fee: Submit the application fee online using net banking, credit card, or debit card. The fee varies by category and position.

- Submit the Application: After carefully reviewing your application, submit the form. Print or save a copy of the application form for future reference.

Selection Process for Income Tax Recruitment 2024

The selection process for Income Tax Department positions involves multiple stages, typically as follows:

1. Written Examination

The initial stage usually involves a written examination conducted by SSC or the Income Tax Department. The exam pattern may vary by position but generally includes sections on:

- General Knowledge and Current Affairs

- Quantitative Aptitude

- Logical Reasoning

- English Language and Comprehension

- Basic Computer Skills (for positions like Tax Assistant)

The written exam is generally objective (Multiple Choice Questions) and may also include descriptive components for certain positions.

2. Skill Test

For specific roles like Stenographer or Tax Assistant, candidates may need to pass a skill test in typing, data entry, or stenography. The requirements for these tests vary based on the position and grade.

3. Physical Test

For fieldwork positions such as Income Tax Inspector and Tax Recovery Officer, candidates may need to pass a physical test to assess their fitness level. The exact requirements will be outlined in the recruitment notification.

4. Interview

Some positions may require an interview to assess candidates’ communication skills, problem-solving abilities, and suitability for the role. Not all positions have an interview stage, so check the official notification for specifics.

5. Document Verification

Shortlisted candidates will undergo document verification, where they must present original copies of all relevant documents, including educational certificates, identity proof, and category certificates (if applicable).

Preparation Tips for Income Tax Recruitment 2024

- Understand the Exam Pattern and Syllabus: Familiarize yourself with the syllabus and exam pattern specific to the position you’re applying for. Focus on subjects like quantitative aptitude, logical reasoning, and general knowledge.

- Practice with Previous Year Papers: Solving past exam papers will help you understand the types of questions asked and improve your time management skills.

- Stay Updated on Current Affairs: For positions involving a general knowledge component, keep up with national and international news, especially related to economics and taxation.

- Improve Typing Skills: For roles requiring data entry or stenography, practice regularly to improve your typing speed and accuracy.

- Take Mock Tests: Mock tests are a great way to simulate the exam environment, build confidence, and identify areas where you need to improve.

- Prepare for Physical Fitness: If you’re applying for a role requiring a physical test, start preparing early by engaging in regular physical exercise to meet the fitness requirements.

Required Documents for Application and Verification

Candidates should keep the following documents ready for both application and verification:

- Proof of Identity: Aadhar Card, Voter ID, Passport, or any other government-issued ID.

- Educational Certificates: Degree or diploma certificates and mark sheets.

- Category Certificate: For SC/ST/OBC candidates.

- PwD Certificate: For candidates applying under the PwD category.

- Passport-Sized Photograph and Signature: As per the required specifications outlined in the application form.

Career Growth and Benefits in the Income Tax Department

Working in the Income Tax Department offers numerous benefits, including:

- Job Security: As a government job, it offers high job stability and security.

- Competitive Salary: Attractive pay scales along with allowances such as Dearness Allowance (DA), House Rent Allowance (HRA), and Travel Allowance (TA).

- Opportunities for Promotion: Regular opportunities for promotion to higher positions through departmental exams.

- Pension and Retirement Benefits: Income Tax Department employees are entitled to pension schemes and other retirement benefits.

- Work-Life Balance: While certain roles may involve fieldwork, most positions offer a balanced work-life environment.

Conclusion

Income Tax Recruitment 2024 presents a rewarding opportunity for individuals looking to build a career in the government sector. With various positions available, candidates from diverse educational backgrounds can find roles that align with their skills and interests. By understanding the eligibility criteria, application process, and selection stages, you can navigate the recruitment process with confidence. With the right preparation and dedication, you can secure a position within the Income Tax Department and enjoy a stable, fulfilling career in public service. Stay updated with official notifications, start preparing early, and best of luck with your application!